Liquidity Meaning, Significance, Types, Measures, Management

Sometimes total liabilities are deducted from total assets to equal stockholders’ equity. Your other fixed assets that lack physical substance are referred to as intangible assets and consist of valuable rights, privileges or advantages. Companies that maintain their assets in an order of liquidity can quickly discern which assets can be tapped at short notice to cover immediate financial needs. The finance term “Order of Liquidity” is important because it provides an overview of a company’s financial stability and efficiency. Creditors are typically more willing to lend money to companies that have more liquid assets because they are less risky. For example, a company may have the cash immediately on hand but also owe money to creditors in the form of current liabilities.

- Aggregated orderbooks pool multiple exchanges into one view, giving traders access to deeper liquidity, better pricing, and smarter execution – effectively creating a unified global market for every asset.

- The returns from alternative investments, which the company might have overlooked due to its focus on liquidity, could surpass the benefits derived from holding liquid assets.

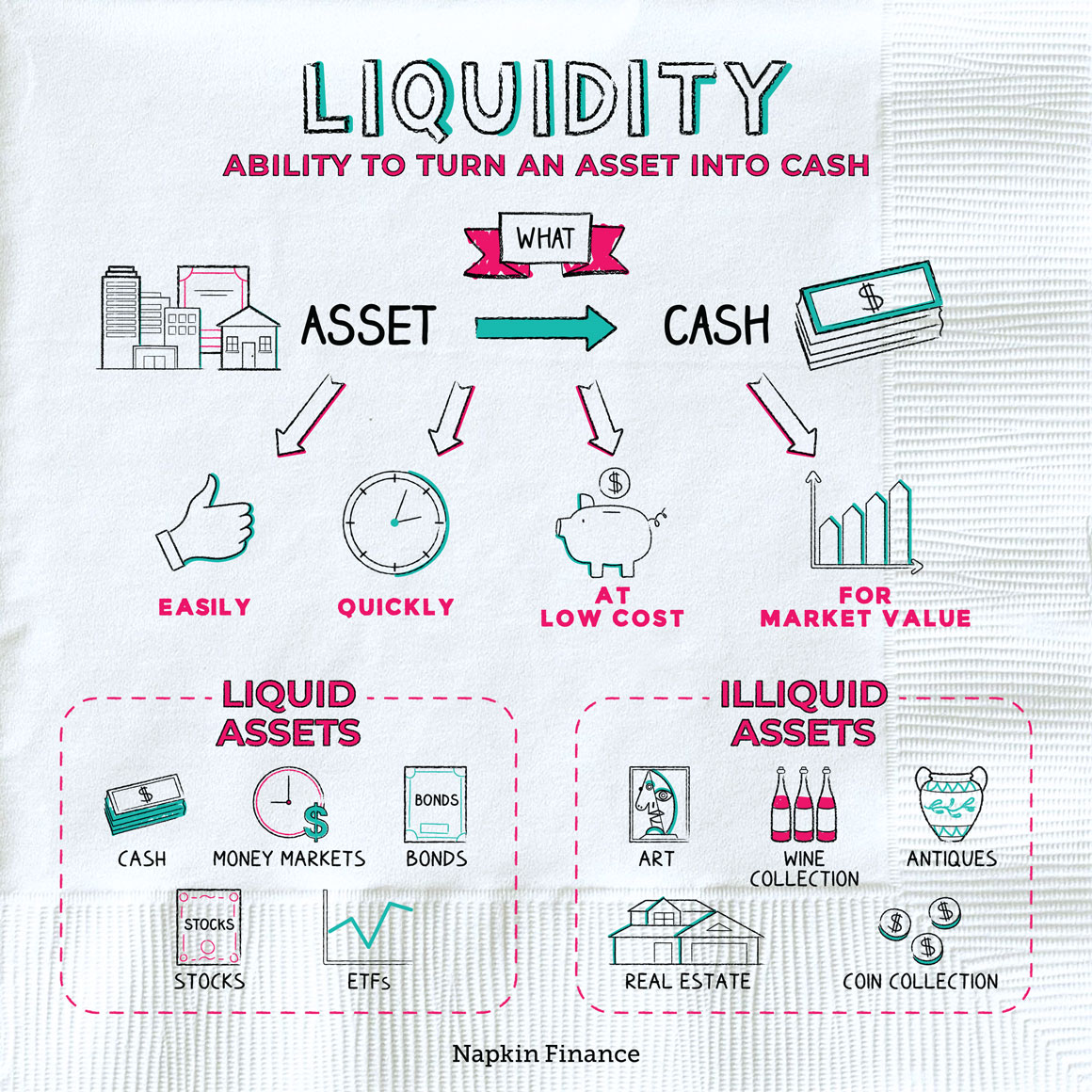

- In simpler terms, it measures how quickly and efficiently an asset can be bought or sold in the market.

- The order of liquidity concept is not used for the revenues or expenses in the income statement, since the liquidity concept does not apply to them.

- You should label all other accounts receivable appropriately and show them apart from the accounts receivable arising in the course of trade.

Quick Tips To Saving Your Way To A Million Dollars

Incorporating order of liquidity considerations in financial modeling can lead to more accurate forecasting of cash flows and better risk management. This, in turn, enhances the overall financial decision-making process and performance evaluation of companies. Understanding the order of liquidity in financial analysis is crucial as it provides insights into an entity’s liquidity position, cash flow management, and risk exposure. Businesses often face liquidity challenges when it comes to realizing deferred tax assets. These challenges stem from the uncertainty surrounding future taxable income and the impact of tax policies on liquidity needs.

What is considered a high level of liquidity?

High liquidity affords companies the flexibility to tackle unexpected expenses, invest in growth opportunities, and reduce their reliance on external financing. The stock market, for instance, is characterized by high liquidity, at least when trade volume is high and not dominated by selling. If a market has high market liquidity, then commodities in that market can be bought and sold at relatively stable, transparent prices. Without sufficient liquidity, businesses can run into disruptions, leading to potential setbacks or even failures. Ready cash is considered to be the most liquid possible asset, since it requires no conversion and is spendable as is. For example, crypto is considered liquid, but it’s less liquid than cash because of the time it takes to turn cryptocurrency into cash.

Aggregated Orderbooks Explained A Quick Overview

Therefore, assets and liabilities on the balance sheet should be shown in the proper order that facilitates a good understanding of the firm’s financial position. These limitations can lead to challenges in accurately assessing an entity’s liquidity position. One major challenge is the potential for misjudging liquidity needs when relying solely on the order of liquidity.

Pooling Liquidity: How Aggregated Order Books Benefit Traders and Exchanges

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

This standard arrangement allows external parties like creditors and investors to easily measure a company’s liquidity. Having a good understanding of the order of liquidity is critical to analyzing the short-term viability of a company, its risk level, and the adequacy of its working capital management. In times of financial distress, the company seeks to liquidate its assets to pay off liabilities, making ‘order of liquidity’ a crucial consideration for potential investors, lenders, and creditors. The next most liquid assets are short-term investments, followed by accounts receivable and Inventory.

This is helpful for varied stakeholders in comparing, analyzing, and decision making as they can easily compare two or more balance sheets of either the same company or any other company. As per this, cash is considered the topmost liquid asset, whereas goodwill is considered the most illiquid asset as it cannot generate cash until the business gets sold. An aggregated order book in crypto brings together buy and sell orders from multiple exchanges into a single view, allowing traders to see broader market depth and access better pricing. This benefits traders by reducing costs and improving trade execution, while exchange operators gain a steadier flow of orders and increased liquidity. Aggregated order books make trading smoother and reflect true market activity across platforms.

The order is important because it reflects which assets you are going to use in order to pay liabilities. Should Trump enact tariffs on the tech necessary to build AI, it could also squeeze the capital needed to fund AI R&D, says Matt Mittelsteadt, another research fellow at George Mason University. During his campaign, Trump proposed a 10% tariff on all U.S. imports and 60% on Chinese-made products.

In this quick article, we’ll explain how aggregated order books work and why they’ve become a powerful tool in the world of crypto trading. Financial liquidity refers to a business’s ability to meet its short-term obligations, while solvency refers to a business’s ability to pay off its long-term debts and obligations. An example is a company with a large inventory and overhead, such as a factory, with plenty of sales and incoming orders, but no cash on hand. The order of what does order of liquidity mean liquidity is calculated using liquidity ratios, such as the current ratio and quick ratio, which measure an entity’s ability to meet short-term obligations using liquid assets. This difference in liquidity poses challenges for businesses, as tying up too much capital in inventory can strain cash flow and hinder flexibility in responding to changing market demands. High inventory levels can lead to increased storage costs, risks of obsolescence, and potential write-downs.