Wells Fargo trailed those people lenders in fund originations through the 2021, predicated on Bankrate, that have Skyrocket Mortgage in the step 1

That staff does increase when interest levels was reduced and you will homes inventory try abundant, and you may feel sharp work cuts when rising rates and rigid list provides discourage to invest in and you may refinancing.

Analysts say Wells Fargo or other federal and you will awesome-local banks have lost market share so you can on the internet creditors, such Rocket Home loan, United Shore Economic and you may Loan Depot.

When measuring by property value money, Wells Fargo is third from the $159 billion, JPMorgan is actually fifth on $134 billion and you may Financial from America Corp. is seventh at $85 million.

Bloomberg News reported when you look at the an Aug. fourteen blog post one Wells Fargo is actually pull right back regarding bringing financing having mortgages created by 3rd-cluster loan providers, as well as offering Government Casing Administration funds.

However,, I guess my section is actually we are really not wanting are extraordinarily high on the home loan company for the fresh purpose of being from the financial business.

Not the only one

The blend out-of even more fintech loan providers, fasten lending conditions due to the fact houses bubble burst regarding 2008-eleven, and you may a sharp slide-out of up to now this current year from inside the refinancing hobby features other banking companies curious its role and you will proportions regarding the field.

The new Financial Lenders Association’s home loan declaration, put-out Aug. twenty-two, discovered most of the financial originations have decrease forty eight% regarding 3.55 million in the next quarter out of 2021 to a single.85 million regarding the 2nd one-fourth of 2022.

Truist captain monetary manager Daryl Bible told you in bank’s fulfilling call with analysts that high interest rates was forcing mortgage amounts and acquire-on-deals margins.

Truist leader Expenses Rogers informed analysts you to financial probably (is) a little apartment last half of the season (in contrast to) the first 1 / 2 of the season.

Tim Wennes, leader of one’s You.S. section to possess Santander, informed CNBC that bank’s choice to leave residential mortgage credit in the March are motivated mostly of the lowering of mortgage quantities. It offers put its lending focus on automobile money, that are giving highest output.

For the majority, especially the quicker organizations, the majority of the home loan frequency try re-finance craft, that’s drying up-and may push an effective shakeout, Wennes told you.

Fintech benefits and drawbacks

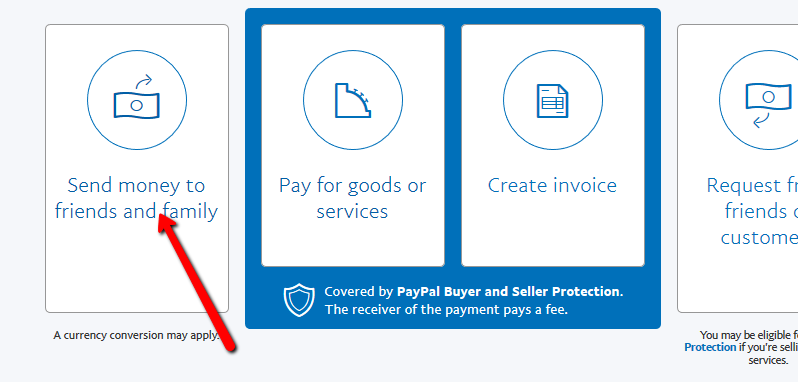

A quick and you will streamlined means is the main aggressive advantage you to fintechs has more than old-fashioned banking companies, borrowing from the bank unions or other traditional mortgage lenders.

Fintechs keeps based its lives to the top utilizing big analysis, analysis analytics, advanced formulas, and artificial intelligence – which permit alternative loan providers to raised evaluate borrower’s creditworthiness and you will visited typically below-served communities, blogged Sandra Lankford inside an excellent July twenty two site to your research enterprise Wolters Kluwer.

Anyone and you can people fill in the recommendations on line otherwise compliment of a keen app, upload data files digitally, and possess some point off contact with the lender.

Option loan providers are not the right choice for everybody home-based or commercial borrowers. Users shop for a knowledgeable interest levels and you can words, that can still are from finance companies.

Though fintech businesses are noted for scientific developments and you will getting properties including digital mortgages, recommendations defense stays a high concern, she told you. At the same time, the government doesn’t manage low-lender creditors since securely since banking companies.

The new responses

Of a lot old-fashioned banking institutions and borrowing commitment enjoys responded to the newest fintech competition because of the seeking incorporate a few of the same large analysis analytics.

For example, Truist might have been expanding to the a digital-basic strategy released in 2019 of the ancestor BB&T Corp. as well as chairman and you may leader Kelly King.

1st named Disrupt otherwise die, the lending company softened the term so you’re able to Disturb and you will thrive since it connected fake cleverness and you can robotics to the the right back-office, customer-service and compliance surgery.