HELOC & Home loan Strategies for the latest Self-Operating

Ready to Help make your Collateral Work for you?

There is lots as said to own self-a position. You are free to prefer whenever, in which, and just how you works. You are not limited to an income, sometimes – your own getting prospective is bound simply by your really works principles, elite solutions, and you will team experienced.

However, getting care about-working do result in the process of applying for a mortgage or family guarantee line of credit (HELOC) more complicated. Loan providers might be unwilling to give to help you worry about-employed borrowers, but you can however establish their circumstances. Keep reading to track down home loan resources and you will find out about bringing finance getting thinking-functioning gurus.

HELOCs 101: Preciselywhat are They to own and how Could you Have one?

A great HELOC is a common way of accessing your own guarantee, the property value your residence without equilibrium into the your own financial. When taking away a good HELOC, you borrow secured on the equity.

A good HELOC try rotating borrowing from the bank. You get acknowledged in order to acquire up to a certain amount and produces distributions as you will, to you to definitely amount, so long as you’re in what is called the draw months.

The fresh new mark period to the a HELOC usually persists five to help you 10 decades. Following, it is possible to go into the payment several months. You can easily prevent borrowing and rather generate typical repayments in order to rebuild their collateral.

As to the reasons an effective HELOC?

- Making advancements or improvements so you can a property

- Buying the next family

- To pay for unforeseen costs particularly medical expenses

- To fund a marriage or any other lives experience

- To pay off a home loan early

The main benefit of having fun with a beneficial HELOC within these factors is that the interest rate is sometimes less than compared to an individual financing or mastercard. As well as, because it’s revolving credit, you pay focus on what you acquire.

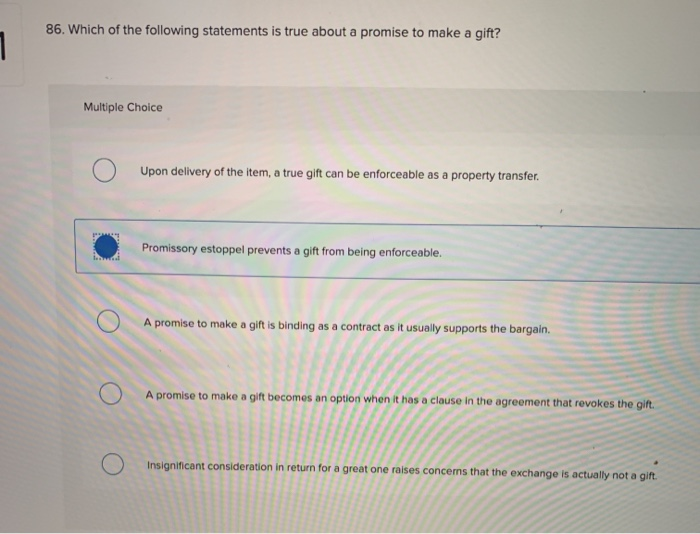

How you Qualify

- At the least fifteen% so you can 20% security of your home. To phrase it differently, the financial harmony are unable to complete over 80% so you’re able to 85% of the home’s value.

- A history of toward-time costs. That applies to your existing mortgage and other costs.

- A credit history that’s comparable to otherwise a lot more than financial minimums. You are going to possess some options as long as their score try regarding mid-600s. The higher it is, the greater possibilities you have, while the reduce your rates will be.

- Month-to-month loans payments totaling only about 43% of your monthly gross income. Loan providers label which the debt-to-earnings proportion.

Getting a good HELOC If you’re Thinking-Employed

HELOC lenders require consumers to possess steady revenues. Whenever a self-operating people can be applied for a loan, they can not submit an excellent W-2 or shell out stubs to show that they earn a certain number and certainly will still secure one to matter for the foreseeable upcoming.

Self-operating pros know that their income are exactly as secure once the that of team – occasionally much more as the a worker hinges on a single providers and a self-operating person typically has several customers. But not, loan providers wanted way more evidence of balance.

A beneficial HELOC often is convenient than simply a personal loan getting thinking-working pros since your house is their guarantee. Of course, you to definitely entails your financial might take your house if you standard toward mortgage.

Converting Guarantee Rather than Borrowing: The brand new Business-Leaseback Solution

For those who have dilemmas qualifying getting a HELOC, you will most certainly also provide dilemmas taking a swelling-share household collateral loan. At that point, it may feel like your own only choice would be to offer your home and escape, but that’s not true.

Additionally there is the option of promoting your home so you’re able to a pals that will then lease they back to you. This can be called sales-leaseback system, also it allows you to transfer your own guarantee instead of borrowing or moving.

Maybe not a citizen But really? Bringing a mortgage While you are Notice-Employed

Delivering a home loan since a home-operating body’s comparable to delivering a HELOC. You are going to need to fill in option evidence of money. In this case, even in the event, you can only have to bring one income tax go back exhibiting several weeks of thinking-employment income.

The fresh hook is that you must have 2 years out-of self-a position history. This new https://paydayloanalabama.com/moores-mill/ exclusion is when you’ve got earlier in the day experience in your own occupation and you are clearly and then make normally while care about-operating as you performed when you was basically an employee. If that’s the case, you just prove one year away from self-employment.