Enhance your Financial Approval Possibility: Insider Ideas to Safer Your dream Household

Thinking from home ownership is exhilarating, however, navigating the path so you’re able to securing home financing feels such as for instance a network out of suspicion. Luckily for us that there exists shown methods you could use to boost your chances of home loan approval. Now, we are going to express resources and you can expertise to help you navigate this new lending land confidently. Whether you are a first-big date homebuyer otherwise trying to re-finance your house loan, these strategies usually encourage that present an effective loan application.

Polish Their Borrowing from the bank Reputation

The credit reputation takes on a pivotal part regarding mortgage approval techniques. So start with getting a copy of your own credit file and checking they to possess mistakes or inaccuracies. Dealing with these problems and you can and make punctual costs can also be change your borrowing from the bank score.

State your discovered a blunder on your credit history one improperly noted a skipped percentage. Speak to your credit rating department and gives evidence of new americash loans Elkmont error to have it rectified. One to, alone, can boost your credit score. Additionally become smart to keep borrowing from the bank utilisation proportion low and steer clear of trying to get the fresh new borrowing before applying getting home financing presenting a credit rating that presents you might be a decreased-exposure debtor.

Save your self to own a substantial Put

A hefty deposit shows financial stability and reduces the chance to own lenders. Very saving vigilantly and you can aiming for a sizable deposit can increase your chances of mortgage acceptance and may even produce lower rates of interest & better loan terminology.

But exactly how might you exercise? Start with exploring budgeting processes and you may reducing too many costs. Including, dine out faster and relieve their memberships to movies streaming characteristics. And, believe innovative an effective way to speed your own discounts, for example creating a dedicated membership otherwise automating regular contributions.

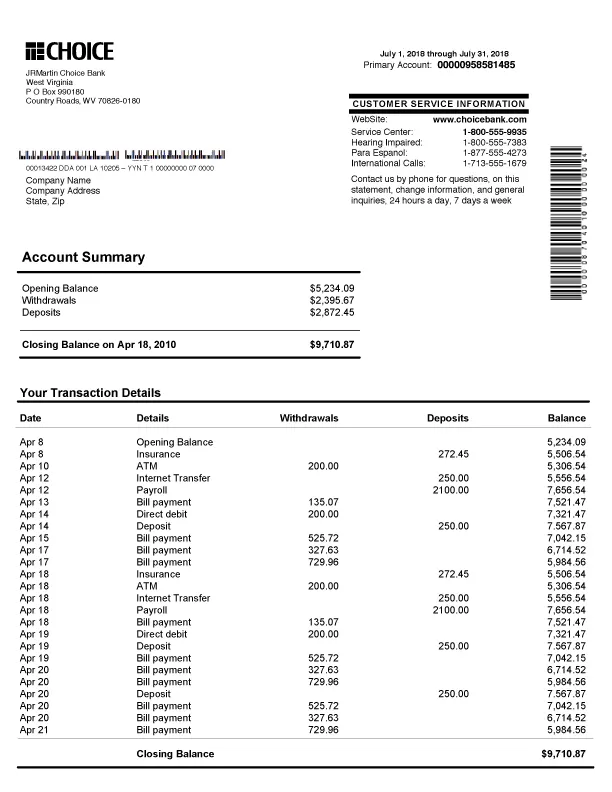

Get your Economic Data files in order

Loan providers want thorough files to check on your financial condition before granting a home loan. So assemble essential files instance pay glides, taxation statements, financial statements and you will proof property. Which have such organised and you may conveniently obtainable commonly streamline the home loan comparison techniques, as it reveals debt obligations. Imagine if youre worry about-working and you can applying for a home loan? Track your income and ensure your own taxation statements are upwards-to-go out and you can appropriate. By doing this, you can offer a clear image of your earnings and you can strengthen your credibility as the a borrower.

Eradicate Current Costs

If you’re asking, Often my home loan feel recognized? look at the expenses. Lenders evaluate the debt-to-income ratio whenever operating the job.

So before applying or re also-making an application for a mortgage, it can help to attenuate the money you owe, eg charge card balance otherwise signature loans. Consider merging debts or applying a personal debt installment decide to program your commitment to monetary balance. If you have multiple playing cards with outstanding balance, it may be best for focus on paying off large-focus expenses earliest to attenuate your general financial obligation stream and you may increase your debt-to-money ratio. One maneuver will make you an even more glamorous borrower.

Manage Secure A career and you can Income

Ways to get acknowledged for a home loan quick? Look after secure work and you will a typical money stream to bolster the application for the loan. When possible, stop changing jobs or jobs within the application for the loan techniques, since lenders normally favor borrowers with a professional revenue stream to own payments. Will you be nevertheless going to button efforts? It may be smart to safe the loan ahead of passing inside the resignation.

Take part a large financial company

Navigating the complexities of the lending land is overwhelming. Interesting a reputable large financial company can provide specialist suggestions designed to help you your specific activities. A brokerage often determine the money you owe, explore offered loan alternatives, and you will discuss on your behalf, boosting your likelihood of wanting a loan that aligns along with your demands. He has use of a comprehensive list of loan providers and can help you browse the fresh in depth application for the loan processes.

A professional large financial company can also provide beneficial knowledge and information with the enhancing your loan application, instance recommending alternative lenders otherwise financial software and this can be more suitable into financial predicament. Its options and you may business knowledge might be priceless in getting a good timely financial approval.

Get in touch with Deltos Financing Now

Regardless if you are buying your first domestic, refinancing your own financial otherwise strengthening wide range using assets funding, Deltos Finance’s regional home loans for the Hobart will help.

All of our mortgage advisors usually assist you on the processes-of letting you polish your own credit character to locating an informed financial activities to you personally. Together with, we grab pride during the that have one of many higher financing acceptance costs certainly one of mortgage brokers in australia. Rely on me to improve your likelihood of mortgage acceptance.

During the Deltos Financing, we do not simply see finance-we strive to produce achievements reports. Get in touch with united states now. We have been excited to-be section of the winning homeownership.