Using Huntington, Energy of Home home owners can apply having an unsecured loan for to $10,000 at a step 3

John Glenn University of Personal Activities Professor Stephanie Moulton has invested their particular research job examining property procedures and you can apps, specifically seeking to an easy way to make homeownership a great deal more fair and you will sustainable.

It isn’t just by way of property that individuals build wide range, it is as a result of house running. Building riches by way of household buying requires tips which are not always open to earliest-generation homeowners, Moulton told you.

The low speed is possible because of a grant in the Kansas Houses Financing Service, which helps protection the loss if someone else non-payments into the loan and assists keep the rates of interest sensible

They truly are tend to getting left behind regarding investing their houses, she informed me: They make excess amount to help you qualify for reduced-earnings grants getting house repairs, however they don’t possess sufficient money otherwise home equity to help you meet the requirements to have reasonable-rates family equity loans otherwise personal lines of credit.

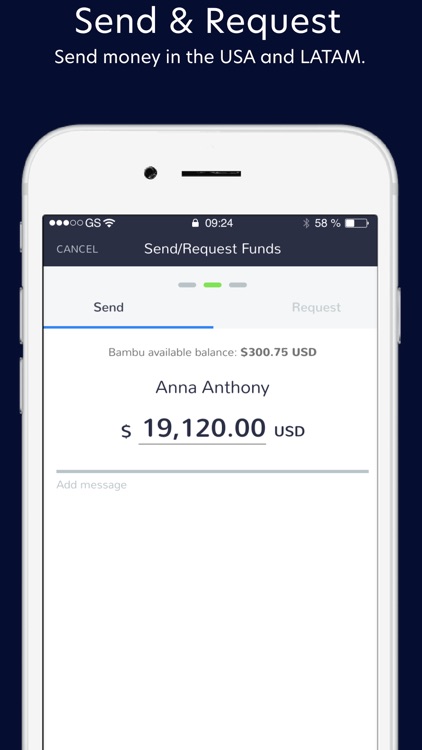

To simply help target such disparities, Moulton prospects a program called Energy from Home, that offers lingering help and entry to resources in order to Kansas very first-day people. In spring 2022, the application form added a new feature: the means to access a reduced-rates mortgage to own household solutions accessible to Power from Home property owners thanks to a partnership toward Huntington National Bank.

Of several earliest-day homebuyers purchase belongings with little dollars off no available collateral, said Jason Fraley, senior vice president and you will captain environment, societal and you may governance officer to possess Huntington. It means consumers don’t have use of guarantee to finance resolve demands. By providing an easily affordable restoration product, i help customers financing these solutions without having to trust higher-costs financial obligation, instance signature loans otherwise credit cards. At some point, we feel this approach boosts the possibilities you to a customer tend to manage to stay-in their property, stop delinquency if they are facing a costly resolve, and you may buy their homes into much time-title, building money.

For free to help you residents, thanks to a grant to help you Kansas Condition of American Family unit members Insurance policies, Electricity out of Family also helps residents with accessibility economic counseling due to Apprisen and you may pre-construction counseling compliment of regional NeighborWorks Kansas groups.

Huntington National Lender managers Jason Fraley, leftover, and you may Barbara Benham, next out of right, explore resident lookup which have Teacher Stephanie Moulton, next away from left, and you will Michael Pires, enterprise director, Energy out of Family

Power of Residence is on the market today to help you very first-time homeowners which purchased property as a consequence of certainly Ohio Houses Finance Agency’s sensible home loan software; although not, the group try trying to develop entry to most other home owners within the Kansas.

Michael Pires, investment movie director to possess Fuel off Home, prospects the fresh conservation and you will durability workstream to possess Overlap Columbus, an effort to boost homeownership to own Black houses from the Columbus area.

Sensible property and renewable homeownership are foundational to items having boosting generational money. Yet it pathway is sometimes faster doable having Black Us citizens whom give a good homeownership price regarding 46.4% than the 75.8% from light group, for each the Brookings Business, told you Pires, exactly who also is the latest give movie director to the Ohio State Battelle Center to own Technology, Engineering and you can Social Coverage on Glenn College or university. Given that homeownership gift suggestions an opportunity for expenditures, to purchase strength and you may boosting credit, it is crucial getting Black colored house and you may therapists so you can prioritize the fresh new preservation out of a house get in order to narrow the fresh wide range gap.

In another relocate to assistance homeowners, Huntington provides a beneficial $three hundred,000 lookup offer to possess Moulton to examine earlier mature homeowners, making sure he’s got reasonable use of their home equity – usually the primary supply of the money. Moulton how to find California installment loans online? along with her acquaintances often become familiar with anonymized savings account investigation supplied by the Huntington and you may borrowing studies understand the outcomes from older grownups have been in the past approved having otherwise declined household guarantee finance. This helps highlight a method to best serve brand new needs regarding older adults.

Older adults have very a touch of collateral in their home, so they you will obtain relatively inexpensively, eg, and come up with adjustment so they can years in position.