Perfect for mid-dimensions HELOCs in the The fresh new Englang and you will Mid-Atlantic urban area

In the Bills, we try so you’re able to make monetary choices with confidence. While many of the affairs assessed are from our Companies, along with people who have and this our company is affiliated and people who make up you, our very own ratings should never be dependent on her or him.

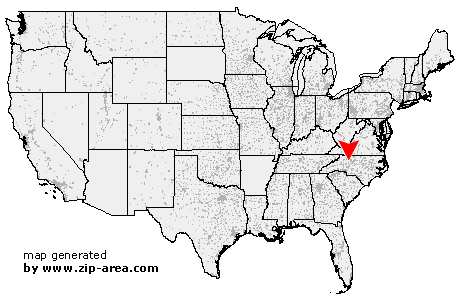

Minimal accessibility: CT, DC, De, Fl, IL, Within the, KY, MA, MD, Me, MI, NH, Nj-new jersey, Nyc, OH, PA, RI, Virtual assistant or VT

Do Citizens Lender Offer Family Equity Loans or HELOCs?

People Bank will not already give household guarantee funds (HELs). However it does offer home equity credit lines (HELOCs).

Indeed, brand new bank’s site might be complicated regarding it. And get a hold of website links so you can home collateral money. However,, when you click on through, you’ll find oneself reading about HELOCs.

Then it Citizens Bank’s maybe not-so-subdued way of suggesting to individuals you to definitely an excellent HELOC can easily substitute for a HEL. However,, if you’re an excellent HELOC could possibly get in a few issues become a reasonable option, both goods are different while the we will speak about in a minute.

And you will really find Going Here that good HELOC would not meet your needs. If so, Citizen Lender cannot help you. But don’t worry. Almost every other lenders promote domestic guarantee finance.

Customers Lender can be shadow their sources back again to an individual Rhode Isle department depending from inside the 1828. Plus it grabbed it nearly 150 age to expand to 31 outlets, all in you to condition.

However,, due to the fact 1980s, Residents Financial keeps switched in itself. Therefore now (after 2021) enjoys 940 branches round the Brand new England and you will with the Middle-Atlantic together with Midwest. The team got property off $188 mil at that time.

The lending company has the benefit of an intensive selection of banking merchandise to users and people, together with domestic equity credit lines. But not, it’s got this type of contours simply on house which can be based in CT, DC, De-, Florida, IL, Inside, KY, MA, MD, Me personally, MI, NH, New jersey, New york, OH, PA, RI, Va or VT. In case the assets is not in another of those individuals states, Residents Bank can not make it easier to.

Owners Lender Household Guarantee Mortgage

Thus Residents Financial cannot provide family collateral loans. Which is an embarrassment just like the HELs establish an effective way having homeowners so you can faucet its guarantee.

Your property guarantee ‘s the count whereby the residence’s sector well worth exceeds the mortgage balance on that family. Constantly, that is merely your existing home loan harmony. But, when you have present 2nd mortgages (HELs otherwise HELOCs), men and women plus number.

HELs are payment loans, fundamentally which have fixed rates and you will fixed words. So you know precisely where you stand: for each and every monthly payment is the exact same in addition to loan have a flat prevent big date. Naturally, the brand new stretched your loan name, the lower for every single payment could well be, as well as the higher your full notice costs.

Dependent on your circumstances, a good HELOC is really as a otherwise better than an excellent HEL. However, they’re completely different monsters.

People Financial HELOCs

One another form of Citizens Financial HELOC is divided into two levels. On basic ten years, its a little while like credit cards. You can borrow, repay and you can use again up to your own borrowing limit. You simply have to pay notice on your own newest balance. This might be known as draw phase.

At the end of the brand new 10th seasons, you enter the cost phase, which continues 15 years. At that moment, you can’t use any further plus costs was reset to cover the attention and you can obvious your debts throughout the leftover decades. Residents Financial HELOC rates of interest was adjustable, which means your fee changes based on the rates and you will leftover balance. The possibility of highest pricing might inspire you to clear their left equilibrium smaller.