Do you know the procedures active in the home mortgage origination procedure?

Home loan origination is the process a debtor comes after to apply for home financing. It also pertains to every procedures top the brand new debtor to locate secrets to the home.

1. Pre-recognition

In several claims, the mortgage process initiate whenever homeowners rating a good pre-recognition regarding a loan provider when planning on taking a tour of the house having possibly the proprietor or even the realtor.

Having a great pre-acceptance letter, save yourself work together with more than-wedding of numerous functions. Within first-mortgage mortgage origination process circulate, you might have to offer specific financial data files to the lender and you can go through a thorough credit assessment. By doing this, the financial institution is also identify your creditworthiness. To the procedure, you are able to mostly have to have the following documents:

- Current comments out of your bank account

- Resource advice

- Up-to-day pay stubs/paycheck slides

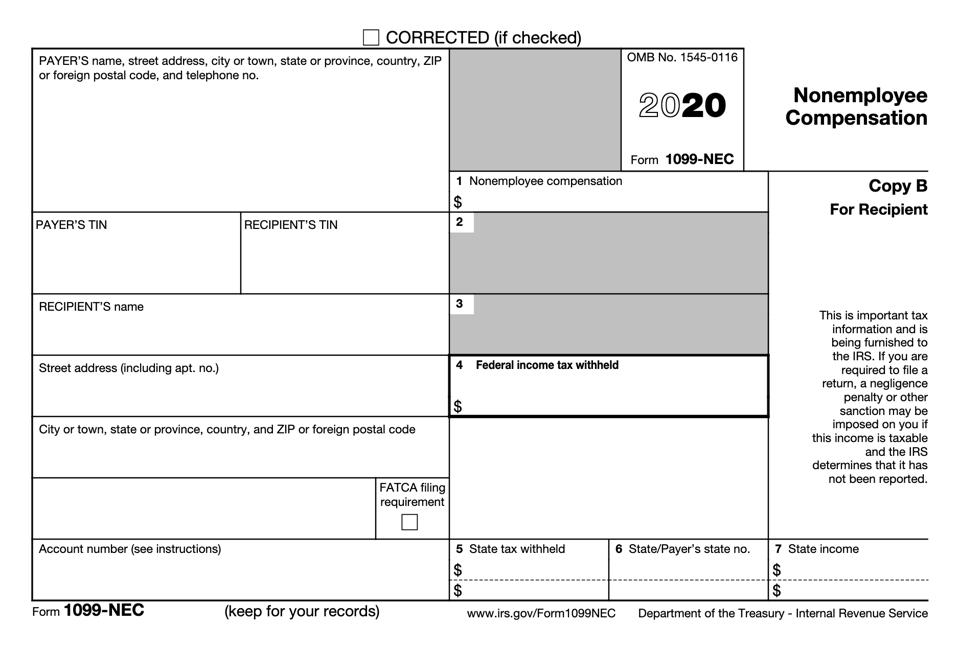

- The past two years cash tax returns and you can W-2s

- The license otherwise passport or one identity facts recognized by the financial institution and/or company

2. Application for the loan

Apart from an effective pre-recognition, you also need to complete a loan application toward specific loan sort of need, requiring an extensive evaluation of your own finances.

To check on your credit history online, without charge, only check out AnnualCreditReport. Whether your declaration happens error-100 % free without having any situations, which is your environmentally friendly rule to make use of. You could start that have an easy online software often from the phone otherwise post. You can agenda a call at-people meeting with your own lender while applying through good financial otherwise borrowing partnership.

Given that app processes continues, chances are you’ll discover financing estimate, as well as a file one to what to the entire will cost you of your mortgage you have taken out.

Loan providers will offer such will cost you initial, which will then allow the borrowers evaluate also offers. For a passing fancy day or maybe just within three days regarding using online, chances are you’ll receive the loan estimate.

You could be prepared for a-one-big date app fee too, which differs from one lender to a different.

3. Financing processing and you will underwriting

In this processes, the financial institution and you can underwriters have a tendency to determine your information, called the exposure reputation, which can help all of them influence the degree of home loan you could potentially take and you may pay back timely.

Expect you’ll answer loads of concerns, fill in several versions, and give those personal data files. You’re anticipated to provide the following guidance as well:

- The money you https://paydayloanalabama.com/calera/ owe, like figuratively speaking or handmade cards

- Your intricate work records and you can money

- Range of possessions, as well as bank account, holds, old age money, etcetera.

- How big is a down payment you may need to pay, and a reason out of in which it is originating from

After this, the lender begins evaluating all of your guidance, either manually or using a certain software. This will help all of them make a decision on the if they should loan you a mortgage or otherwise not. The time has come whenever a lender chooses to approve or refuse the loan. They might also inquire about much more information otherwise records to carefully learn their document.

4. The new closing

At that step, you are going to need to indication documentation saying your invest in the mortgage conditions and you may complete import of the home to discover the secrets on the brand new home. Brand new paperwork might highly recommend you take full responsibility to possess spending closing costs, and that typically is a keen origination percentage plus the debts the fresh bank charges for starting and you will running the mortgage.

This can be only a percentage of loan amount. It is one of the ways to possess loan providers to fund the costs for approaching your loan. A pretty common matter try step 1%.

For instance, the lending company can charge your a $step 3,000 origination payment to your good $three hundred,000 financing, which could include that financial to some other and by business.

Your financial can also charge you other charge, and additionally underwriting or a document preparation percentage. If there is zero origination payment, their lender’s payment could be depending according to the price otherwise financing earnings.

Due to the fact loan providers is actually to own-profit organizations that will be competing regarding the loan company, youre motivated to research rates. Just remember that , settlement costs and you will prices will certainly will vary. However some loan providers could possibly get discuss, anyone else might not.

There are various an effective way to discuss settlement costs. You could potentially pose a question to your bank to possess a cost savings or feel the seller slope in. It’s also possible to roll the costs into your financing. This should help you spend less upfront, however it costs more over the life span of the mortgage. not, there are also free and open-origin mortgage administration software readily available.

Easy a means to apply for an interest rate

The borrowed funds mortgage origination techniques circulate should be time-consuming and incredibly tiring to you personally. It can save you oneself regarding all problems when you’re well-prepared to your following the.

step one. Look at your credit

Establish should your credit score matches the minimum standards and you will whether the statement is completely error-free. If you learn derogatory scratches, such as for example a repossession, you will be concerned about getting an excellent repo off your credit history to enhance the get. Earnestly deleting inaccuracies or paying down disputes can notably change your creditworthiness. If you have a higher score, you will get top selection and will need to pay reduced desire.

You could potentially enhance your rating from the cutting your borrowing from the bank use rates, staying at the top of your instalments, etc. Stay away from one later repayments on your rent, credit cards, college loans, otherwise car and truck loans. Together with, be certain that to store the same job since stability will always remain an important factor to own a lender.

dos. See the sorts of mortgage you would like

Begin by knowing the different kinds of financing- of conventional to help you USDA finance. Research when you look at the-depth knowing which one fits your money and you can condition this new finest.

step three. Usually examine now offers regarding more loan providers

To stay within this finances, find a very good bank. Talk to plenty of lenders, and inquire friends and family, relatives, and you can real estate agent who they had recommend and exactly why.

Different varieties of lenders

You can find different varieties of lenders, as well as community banks, borrowing from the bank unions, federal finance companies, home loans, mortgage lenders, and online lenders. For every single county provides a construction business that closely works closely with loan providers of all categories and might feel a place for you to begin with.

All the county possess a mission-based’ housing funds you to definitely sells tax-exempt securities to help with deal home loans in order to first-go out homebuyers and you will pros. Nonetheless they provide downpayment help people.

There you really have they! Hopefully you become a bit more knowledgeable concerning financial loan team techniques now than you used to be prior to. This type of guidelines will make you feel at ease with what can be expected in advance of to find another type of property.