In the morning We eligible to sign up for Life insurance policies to have CIBC Mortgages?

When you purchase a property, you want security to go along with it. Financial Life insurance step 1 may help include what is actually almost certainly certainly your own family’s most crucial possessions by paying of otherwise reducing your mortgage loan in the eventuality of your own passing.

Home loan Life insurance coverage try underwritten by the Canada Life Promise Organization (Canada Lifestyle). Purchase of it insurance policy is optional that is not essential to help you see one CIBC service or product.

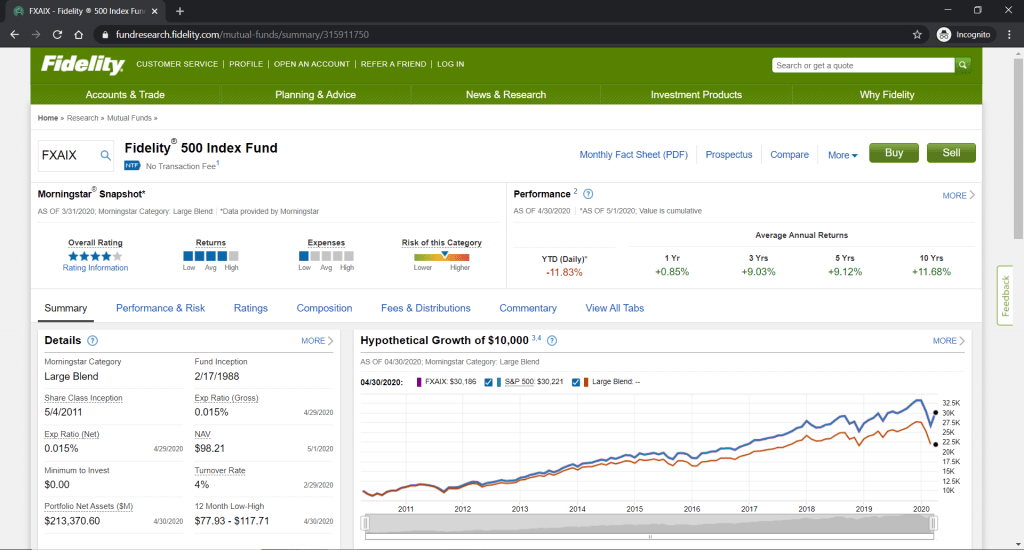

Your own Financial Coverage advanced is founded on your age toward time of insurance policies app, the initial insured quantity of the home loan and relevant advanced speed about speed table below.

Financial Life insurance month-to-month premium rates for every single $step 1,000 of one’s first covered amount of the mortgage (appropriate taxation will be added to your own advanced):

Their month-to-month Home loan Life insurance policies superior = the initial covered quantity of their financial ? step 1,000 ? relevant superior rates.

Essential data files

Your own Certification of Insurance tend to support the complete information on the visibility, also professionals, cost, qualifications standards, constraints and you may exceptions.

Tip: Down load the form because of the right-clicking new document and looking Help loans in Pleasant Groves save hook because. You may then unlock it playing with Adobe Acrobat Reader.

Information regarding CIBC

CIBC get fees on insurance provider, The Canada Lifetime Assurance Team, to own delivering services to the insurance company of which insurance coverage. As well as, the risk within the class plan are reinsured, in whole or in part, to a reinsurer affiliated with CIBC. The newest reinsurer produces reinsurance income under which arrangement. Representatives producing it insurance with respect to CIBC may discovered payment

Frequently asked questions

- You may have responded No to all applicable health issues for the app; and you may

- The CIBC Home loan could have been acknowledged.

In all other activities, the latest insurer (The brand new Canada Existence Promise Business) will remark your application. In the event the software is accepted, the new insurance company have a tendency to give you advice written down of your own go out their insurance coverage initiate. In case your software program is not approved, the fresh new insurance carrier gives you an alerts out-of refuse.

Visibility would also prevent for a lot of other explanations. To possess a whole variety of grounds, refer to this new Certificate out of Insurance to possess CIBC Mortgages (PDF, 310 KB) Opens up within the a new screen.

An insurance work with won’t be paid when the:

There are many restrictions and exceptions. To own a whole checklist, refer to the brand new Certificate away from Insurance coverage for CIBC Mortgage loans (PDF, 310 KB) Reveals inside a new screen.

30-big date opinion months:

You have thirty day period on the go out obtain their Certification off Insurance to review your coverage and decide if this match your circumstances. If you cancel their visibility during this 31-date feedback period, might found an entire refund of any premiums reduced.

Start-off

To find out more from the tool conditions and terms otherwise after that assistance, telephone call CIBC’s Creditor Insurance rates Helpline at step 1-800-465-6020 Opens your cellular telephone app. .

Fine print

step 1 Home loan Life insurance policies try a recommended creditor’s category insurance policies underwritten by the Canada Lives Guarantee Team (Canada Lives) and you will applied from the Canada Existence and you may CIBC. CIBC get costs regarding Canada Existence to possess delivering attributes so you can Canada Lives out-of so it insurance rates. And additionally, the risk in group insurance policy may be reinsured, entirely or even in part, to a good reinsurer connected to CIBC. This new reinsurer produces reinsurance earnings not as much as that it arrangement. Agents creating which insurance with respect to CIBC may discover payment. So it insurance policy is subject to qualification criteria, restrictions and you will conditions (being factors whenever pros is actually restricted or perhaps not paid). On the complete small print, comment the shot Certification out-of Insurance (PDF, 275 KB) Opens into the a new window. . You can contact Canada Lives at step one-800-387-4495 Opens the cellular phone software. . O r you can check out canadalife Reveals inside the an alternate window. . The information in these pages are general just. Services its possess can get transform anytime. If there is discrepancy involving the guidance and you will examples provided to your this page plus Certificate off Insurance policies, your own Certificate away from Insurance prevails.