Just how can home loan places from inside the Ireland works?

Before you can rating a home loan to get a home in Ireland you will need a deposit. This is how it works and exactly how far you’ll need to enjoys stored.

What is home financing deposit?

All the loan providers wanted home financing deposit when you buy a domestic assets from inside the Ireland. It handles lenders if you fall behind on your own money, and you will reduces their threat of credit.

The higher your deposit, the brand new less you have got to obtain to pay for price of your property and a low mortgage so you can value (LTV) can often make it easier to hold the best rates of interest.

Simply how much put would you like for a home loan?

It’s an amount of the property worth, so the deposit count is based on the price of this new property we need to buy.

- 10% when you find yourself purchasing your basic house

- 10% if you have possessed a house in advance of

- 30% if you find yourself to shop for a home so you can book

The size of your deposit and you can LTV may also affect the sale whereby you’re eligible. A tiny deposit may restrict just how many options you have whenever you appear to possess home financing.

Which have a more impressive put, home financing is check advance near me Ohio much more reasonable. You have access to the lowest priced mortgage cost in the market and you can have the best sales.

When you look at the , the mortgage lending laws and regulations changed. First-go out people is now able to acquire fourfold their income, and you will 2nd-time people today you desire in initial deposit away from 10%.

Precisely what does LTV imply?

LTV is short for financing so you can value, and thus how the loan’s proportions comes even close to the brand new property’s total value. Therefore if our house we need to purchase can cost you 3 hundred,000 and you should obtain 250,000, you should have an LTV from 83%.

With an LTV out of lower than 60%, you’ll likely get the very best choice of mortgage product sales as well as the lower rates.

Instance of LTV

Case in point from exactly how your own deposit influences your own LTV and the rate you will be provided. You really need to proceed to a bigger possessions and you can propose to pick a property you to will cost you 350,000. Your own deposit are 75,000 (21% of the property worthy of).

The dimensions of their put mode you ought to obtain 275,000, thus you can easily qualify for financial items that require an LTV out of 80%.

Protecting to own in initial deposit

Since there is no-one most practical method to keep right up to own a mortgage deposit, some things you are able to do in order to rates things right up are:

- Downsizing otherwise moving in that have family unit members otherwise family members to save money towards book

- Switching your family bills such as your opportunity or broadband to reduce can cost you

- Establishing a standing order per month to access the fresh practice of saving

- Looking at your borrowing, to ensure it is not charging over it needs to

- Examining their savings to evaluate they are making around it is also

- Switching their expenses models elizabeth.grams. fewer takeaways and you can dishes aside

It’s also worth considering means an objective. Work out how far you will want to save monthly in order to hit their address and stick to it.

How long will it sample help save to possess in initial deposit?

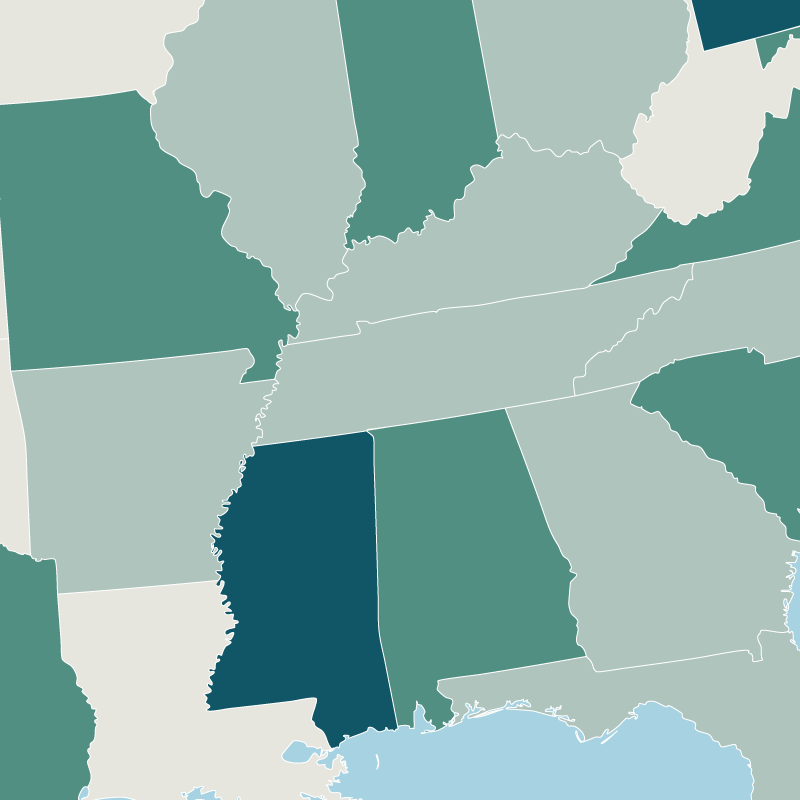

is the reason Cost Index shows the lowest priced parts to own joint people and you can only buyers based on how a lot of time it could sample save yourself getting in initial deposit for the per RPPI region.

Assistance with their financial put

Rescuing a mortgage deposit usually takes a long time, but you will find some the way to get help toward rates.

Earliest Family Scheme (FHS)

The FHS was designed to make up people shortfall between the domestic rate and you can what you are able be able to shell out with an effective put and you will financial.

It’s a shared equity program you to definitely pays doing 30% of your home rates in return for a share on your own possessions. You can get back this new display as much as possible be able to, however, you may be around zero obligation to take action.

When you’re an initial-time client purchasing a different generate family when you look at the Ireland, you could potentially be eligible for the assistance to order incentive.

not, the worth of the latest plan has been temporarily risen up to a good maximum out-of 31,000 or ten% of the price of the property, almost any is the lesser, until .

You can find out more info on the assistance buying added bonus and the ways to use for the Customers Guidance webpages.

Help from the ones you love

While you are taking funds from a relative towards your deposit you’ll also need a letter guaranteeing it’s a gift on people giving you the bucks. That it letter will be closed you need to include:

It’s also well worth checking if there are people income tax ramifications, since the large gift suggestions might slide into the extent regarding merchandise and you will inheritance income tax.

Next measures

Once you’ve the put spared and you know how far you might borrow, you can consider obtaining a mortgage. Realize our Complete Self-help guide to Mortgages to find out more from the applying and securing a deal.

When is it necessary to afford the deposit?

You always need to transfer the brand new put loans immediately after finalizing their deals. So far you legitimately agreed to find the property and have been in the procedure of finishing the acquisition.