The fresh cost is normally made towards the termination of the fresh loan’s term or from the most prevent

Amortization Agenda

- Graph

- Schedule

In this post

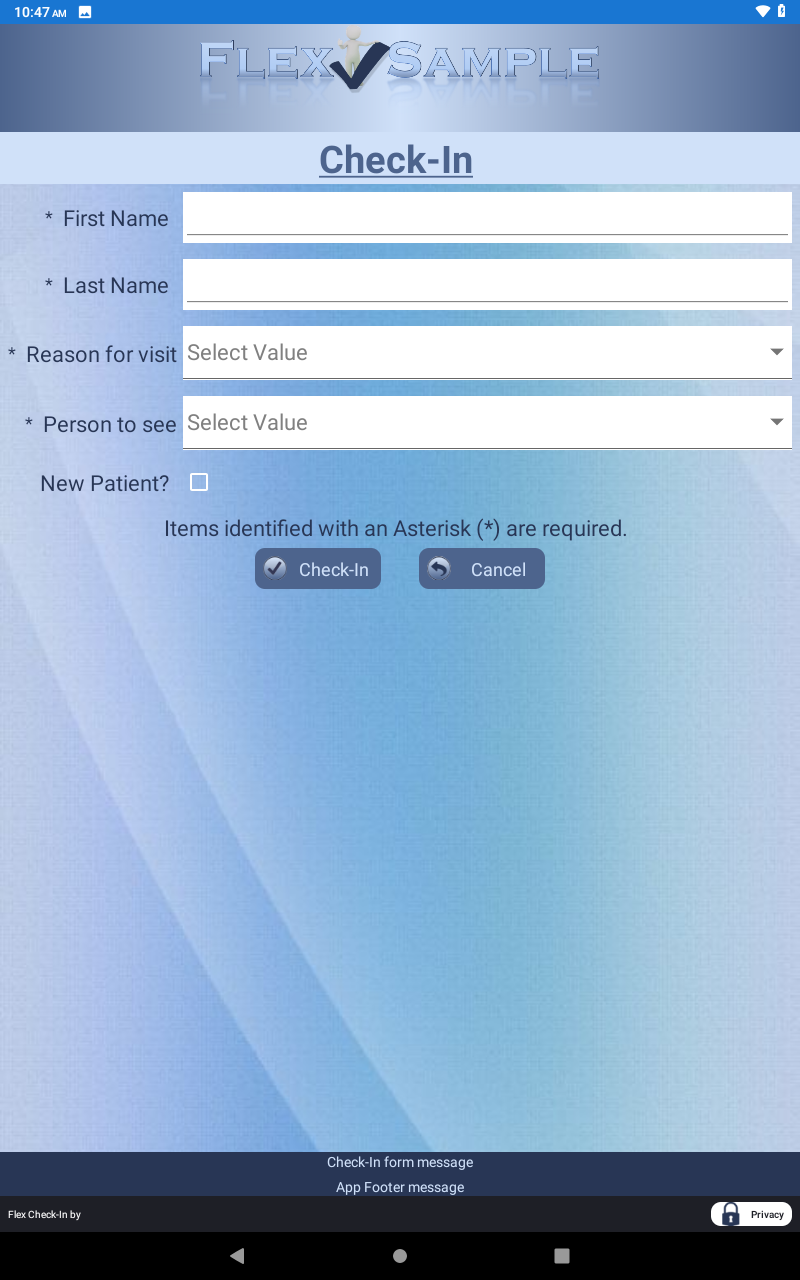

- Utilising the commercial home loan calculator

- Conditions knowing when making an application for a commercial home loan

Explore our totally free industrial mortgage calculator in order to estimate this new specifics of a commercial mortgage quickly and easily. In line with the data your input, the commercial online calculator will help you determine your projected month-to-month Principal and Desire (P&I) percentage into loan and you may a destination Merely commission and Balloon percentage.

Whether you are considering Federal national mortgage association Multifamily financing, Freddie Mac computer Multifamily loan, CMBS mortgage, or FHA/HUD commercial multifamily loans, there are many specifics you should bring. You will have to know the:

- Dominant Loan amount ($)

- Interest rate (%)

- Readiness (years)

- Amortization (years)

The size of extremely Industrial real estate mortgages varies from four many years (or smaller) in order to 2 decades, therefore the amortization months is normally more than the expression away from the mortgage.

Commonly overlooked is the amortization schedule whenever calculating costs. Occasionally brand new amortization may have a more impressive influence on the brand new payment than the real interest of the commercial mortgage.

Just what A home Mortgage Calculator Suggests

New amortization agenda shows exactly how your monthly homeloan payment is split between attract and prominent along the time of the loan. Much of your payment is certainly going toward focus at the start of your own loan, however, it’ll move to generally supposed for the the bill as your financial nears the avoid.

When comparing whether or not you really can afford a specific home loan, it is important to understand that their mortgage payment try just one of your own will set you back that come with purchasing a professional assets. Additionally have to pay insurance costs and you will fees, and they can cost you appear to score separated to your monthly escrow payments in the event they have been due only once annually.

Other expenditures to remember are surroundings charge, power will cost you (plus heating and air conditioning costs) and you can restoration can cost you. Their mortgage repayment and all these types of most other expenses should fit comfortably into the businesses monthly funds.

Conditions to know Whenever Trying to get a professional Home loan

Since you believe some other a home home loan solutions and rehearse the new mortgage calculator, there are a few tech terms and conditions to be familiar with and now we a beneficial

Amortization Several months: A way of loans fees, in which fixed repayments are designed on an effective prepared schedule. The fresh new costs is split up ranging from principal and you may appeal. Very amortization times decrease simply how much out of an installment visits appeal and increase how much cash would go to dominant just like the mortgage continues.

Balloon Fee: A one-go out payment that’s produced at the a particular part of an effective loan’s payment agenda. Balloon payments become more common to your industrial a house mortgage loans than domestic home loans, even though many mortgage loans having balloons are available.

Debt Solution Publicity Proportion: Known as DSCR, the debt solution visibility proportion procedures a good borrower’s capability to pay to the that loan. In order to determine DSCR, separate your own web operating money by the full loans services. Any worthy of significantly more than that suggests that your debt is too far for anyone otherwise company.

Collateral: The brand new advantage that’s accustomed safe that loan. If the debtor neglect to pay towards the a loan, the financial institution get seize one guarantee that is provided from the financing. Having a home mortgage loans, brand new equity made use of ‘s the property that is bought.

Loan so you can Really worth Ratio: Commonly referred to as LTV, the loan so you can value ratio to choose exposure coverage and to measure a borrower’s leverage. The fresh ratio try determined by the splitting the borrowed funds number (principal) by the overall worth of the fresh resource (collateral).

Debt Give A ratio that displays the amount of money generated by a good assets than the simply how much was borrowed via a loan. The latest yield is actually calculated by the splitting online doing work income of the financing matter (principal), also it reveals what the bucks-on-cash production could be getting a lender in case of foreclosure.

Maturity Go out: Sometimes called brand new life span regarding that loan, the new readiness day is the go out about what a great loan’s latest principal percentage is established. Desire isn’t really energized next commission is made, and the financing is considered to be paid in complete in the this point.

Primary Speed: The quality price utilized when you compare interest levels provided by some other lenders. The pace are what is granted in order to a lender’s extremely credible clients. Of numerous customers shell out a higher rate based on the creditworthiness, however, all the pricing derive from it rates.

Prepayment Penalty: Prepayment charges come into the form of action-down prepayment punishment, and that initiate on a particular commission and you will go down of the 1% annually. To possess conduit financing, and CMBS they are usually offered in the type of produce restoration or defeasance. Produce restoration need a debtor and come up with a repayment so you can an effective lender that compensates all of them for the attract productivity they will possess gathered met with the debtor not paid off the mortgage very early. Defeasance occurs when a debtor commands a container out of bonds when you look at the order to restore the fresh new guarantee of the loan.

Dominant and you can Focus: Known as P&We, prominent and focus are a couple of type of facts within a genuine house mortgage. Principal is the modern amount borrowed throughout the lender, and you can attention is the matter energized to possess borrowing the main. Together, prominent and you can desire make up what exactly is repaid of all important genuine property mortgage loans.

Refinance: A system through which a lender and you will obtain invest in enhance or rewrite new regards to that loan. The first financing is https://cashadvancecompass.com/payday-loans-oh/ effortlessly believed paid in complete from the time of refinancing, therefore will get substituted for an alternative loan.

Non-Recourse: A low-recourse commercial mortgage is certainly one where a lender usually do not take to to visit after a good borrower’s individual property when they standard into their personal debt. But not, really non-recourse finance have were stipulations the financing will become a beneficial full recourse economic tool should the debtor break particular statutes, particularly intentionally declaring personal bankruptcy or providing misleading monetary guidance so you’re able to the lending company.