The reason why you Need a proven Approval Page When purchasing a home inside the California

Obtaining a proven approval letter to possess home financing just before searching for a property also offers several advantages. First, it gives a definite understanding of your financial allowance and also the rates variety inside which you can conveniently store. This information facilitate narrow down your quest and conserves date by the emphasizing characteristics one to align along with your economic capabilities.

That have a verified acceptance page and additionally advances your dependability because a client. Vendors commonly favor has the benefit of off pre-accepted consumers, whilst reveals the seriousness and you may monetary maturity. This may give you an aggressive line inside a simultaneous-render disease, enhancing the odds of your offer becoming acknowledged.

Additionally, pre-approval will give you assurance when you look at the real estate techniques. Understanding that you’ve got currently secured money up to a certain matter relieves uncertainties and you may enables you to make pretty sure behavior when and come up with an offer. It does away with danger of falling in love with property simply to afterwards learn you can’t secure a mortgage for this.

Entertaining with a loan officer in the beginning is effective having information the loan process and you may preparing for homeownership. These masters can provide beneficial wisdom to the offered financing choice, advance payment requirements, and you can possible closing costs. They’re able to assist you from pre-recognition procedure, helping that have file preparation and guaranteeing a soft change toward homebuying phase.

What is the difference between pre-qualification and you may pre-approval?

Many people uses new conditions pre-degree and you can pre-acceptance interchangeably, but they are not similar. An element of the difference is the fact pre-qualification will be based upon every piece of information your tell your mortgage officer, without any added verification of related data files. For individuals who offer particular recommendations, it is likely that this new terms of your own pre-qualification might be nearly same as the pre-recognition.

Although not, pre-acceptance need a far more thorough examine of the financial situation. Documentation will be given for you of the me personally, your loan manager, possibly by way of conventional confirmation off employment and you may earnings including W-2s or by way of financial statements and other confirmation while you are implementing as a home-operating borrower.

Pre-acceptance is needed to build a deal on the a house. When you find yourself pre-certification is a superb first rung on the ladder, moving on so you can pre-recognition assists you to be in a strong standing so you’re able to convey more promise regarding the regards to your loan in order to start making now offers to your potential the homes.

Perform I wanted a proven approval letter?

A proven acceptance page (both named a good VAL) is actually a document from the financial that displays your own strong monetary status and you can recognition so you can acquire the quantity you are giving towards the a property. With a good VAL enables you to generate a healthier provide since the it tells owner that you have already affirmed you find the money for followup on the offer make. A vendor is much more attending like an offer having good VAL whenever there are numerous also provides made since it is new much more reputable solution, exhibiting a buyer which is severe and you may financially navigate to the web-site wishing.

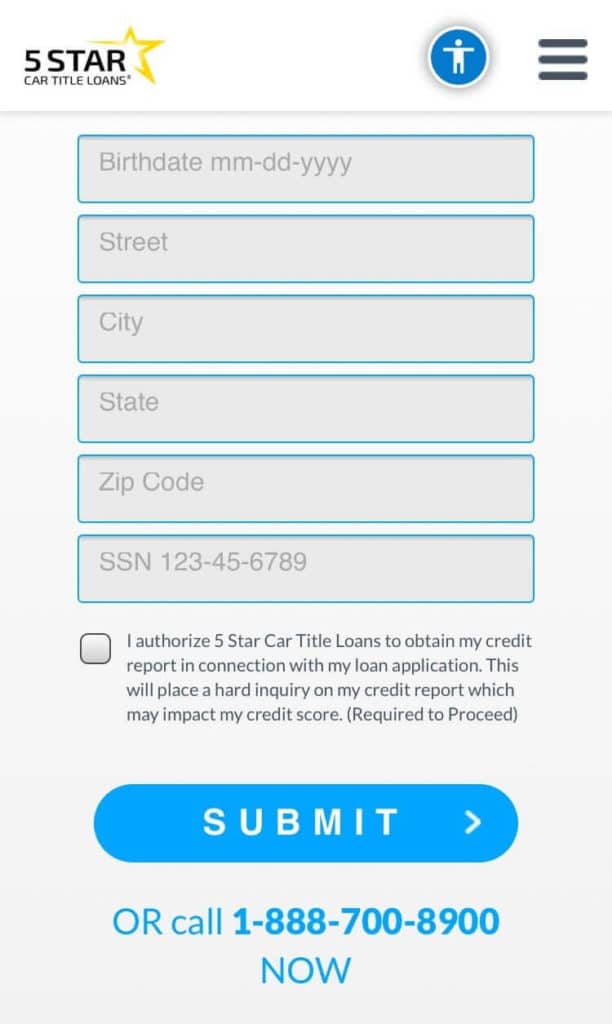

How can i get a proven recognition letter?

Delivering a proven recognition letter is an easy process once you were pre-recognized. According to the type of financial youre likely to explore along with your a job position, the fresh new data want to help you secure pre-acceptance can differ. Generally, your financial will have to find specific combination of:

- W-2s on the previous 2 years

- Two years off a career records

- Lender statements

- Paystubs

- Tax production

- Contracts and you may related files regarding your company, whenever you are mind-employed.

Your lender will additionally check your credit history and you may obligations-to-income proportion. All of these points shared will assist create the full photo of the finances and what you would become acknowledged to borrow. Once this pre-acceptance techniques is done, it’s not hard to consult the new VAL to use through your domestic-query excursion.